Shoe Zone UK: Store Closures, Share Price and What Lies Ahead

Shoe Zone UK: Store Closures, Share Price and What Lies Ahead

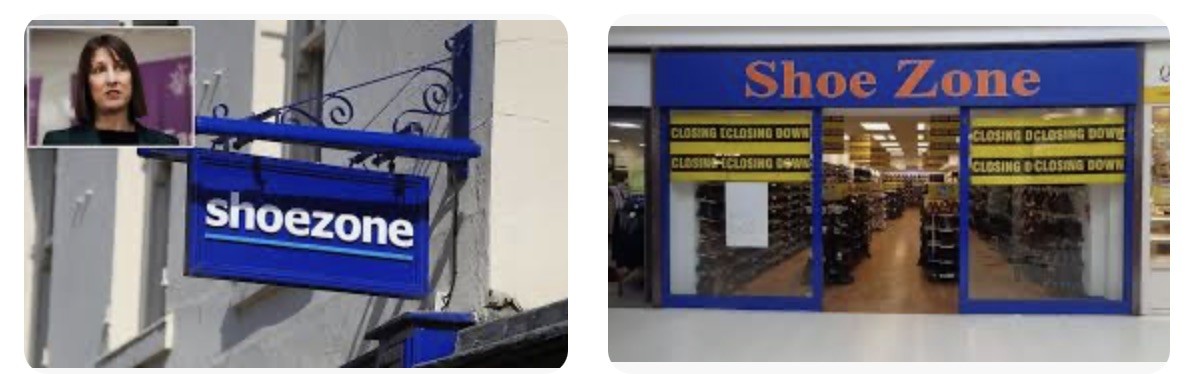

Shoe Zone has long been a familiar name on high streets across the UK, known for affordable footwear and family-friendly styles. But in recent years, the retail landscape has changed dramatically. As economic challenges and digital competition rise, questions about Shoe Zone store closures, its share price, and the overall direction of Shoe Zone UK have gained attention. This article dives into the brand’s current status, financial performance, and what customers and investors should know moving forward.

What is Shoe Zone? A Look at the British Brand

Founded in 1917, Shoe Zone is a UK-based footwear retailer offering low-cost shoes for men, women, and children. It operates through a mix of high street stores and an online platform, providing access to popular brands like Lilley & Skinner, Softlites, and more. With over 300 stores at its peak, the brand became a staple in budget retail.

But as with many high street retailers, Shoe Zone has had to adapt. With consumer behaviour shifting online and economic pressures squeezing profit margins, the company has faced tough decisions.

Shoe Zone Store Closures: What’s Happening and Why

Why is Shoe Zone Closing Stores?

In recent years, Shoe Zone store closures have made headlines. These closures aren’t necessarily signs of collapse but part of a wider strategy to adapt to changing consumer habits. With more shoppers choosing to buy shoes online, maintaining a large physical store network has become increasingly costly.

From Peak to Streamlined

At one point, Shoe Zone operated over 500 stores. By 2025, that number has significantly decreased, with around 300 locations still open. The closures have mainly targeted underperforming stores in high-rent areas. CEO Anthony Smith has spoken publicly about the "business rates crisis" affecting brick-and-mortar retail, especially in small towns and city centres.

Is Your Local Shoe Zone at Risk?

Shoe Zone continues to evaluate each store based on sales performance and overhead costs. If you're concerned about your local shop, it’s worth checking the company’s store locator online, which is regularly updated. However, the brand has reassured customers that closures are strategic, not chaotic.

Shoe Zone Share Price: A Snapshot of Investor Confidence

How is the Share Price Performing in 2025?

Shoe Zone is listed on the Alternative Investment Market (AIM) of the London Stock Exchange under the ticker SHOE. Like many retail stocks, its performance has seen ups and downs, reflecting broader economic trends and sector-specific challenges.

Recent Share Price Trends

In early 2025, Shoe Zone's share price has remained relatively stable, trading in the 200–220p range. This is a modest recovery from earlier years when the COVID-19 pandemic and inflationary pressures caused volatility. The company’s focus on digital expansion and cost control has improved investor sentiment.

What Influences SHOE’s Stock Value?

Several factors affect the share price:

- Store performance and closure announcements

- Online sales growth

- Overall UK retail sector health

- Public spending trends

- Dividends and financial reports

While not a high-growth tech stock, SHOE attracts interest for its dividend yield and defensive market position in value retailing.

Shoe Zone UK in the Digital Age: Adapting for the Future

How Has Shoe Zone UK Embraced E-Commerce?

As footfall on the high street declines, Shoe Zone has invested heavily in its online store. With free delivery options and easy returns, the digital platform now accounts for a significant portion of total sales. The company has also redesigned its website to be mobile-friendly and user-centric.

Customer Experience & Online Convenience

Shoe Zone’s online store offers regular discounts, seasonal promotions, and exclusive products not available in physical shops. It’s also easier to browse by category, size, or brand-something in-store shopping often lacks.

Social Media & Marketing Shifts

In 2025, Shoe Zone has also stepped up its social media presence, particularly on Facebook and Instagram. Influencer collaborations and user-generated content have brought a fresh, modern feel to the traditional brand.

Challenges Ahead: Can Shoe Zone Stay Competitive?

What Are the Risks?

Despite progress, Shoe Zone faces stiff competition from major online retailers like Amazon, ASOS, and even supermarkets expanding their shoe ranges. Rising inflation, fluctuating exchange rates (due to global sourcing), and unpredictable consumer confidence continue to pose risks.

Is There Still Room for Brick-and-Mortar Shoe Retail?

Surprisingly, yes. While many stores have closed, the remaining ones often thrive in smaller communities with limited retail options. Shoe Zone’s ability to offer affordable, durable footwear keeps it relevant, especially for families and seniors.

Is Shoe Zone UK Still Worth Watching in 2025?

Shoe Zone may not be grabbing headlines daily, but its quiet resilience in the face of modern retail challenges is worth noting. While store closures are part of its necessary evolution, the company continues to serve millions through both physical and digital channels.

For investors, the Shoe Zone share price offers a cautious yet steady opportunity, particularly for those seeking dividend income and exposure to defensive retail.

For shoppers, the brand remains a reliable source of budget-friendly shoes across the UK, both in-store and online.

As the company adapts to 2025’s retail realities, its future will depend on how well it balances tradition with innovation.

FAQs

Why is Shoe Zone closing stores?

Shoe Zone is closing underperforming stores to cut costs and focus on digital growth, especially as more consumers shop online.

What is the current Shoe Zone share price?

As of 2025, the share price typically ranges between 200–220p, showing moderate stability compared to previous years.

Can I still shop at Shoe Zone in person?

Yes, over 300 stores remain open in the UK, with a focus on well-performing locations.

Is Shoe Zone a good investment?

It depends on your strategy. The stock is low-risk and pays dividends, appealing to long-term, income-focused investors.

Reactions

Be the first to write a review.

Shoe Zone is one of the most well-known shoe retailers in the United Kingdom, popular for its affordable and versatile footwear for the whole family. Whether you’re looking for school shoes, kid

Read more

14-12-2025 - Shoe Zone: Returns Policy, Kids Sandals, School Shoes, Sport

Shoe Zone is one of the UK’s leading footwear retailers, offering affordable and stylish shoes for all ages. From kids’ sandals to school shoes, sports shoes, and leather shoes, Shoe Zone

Read more

19-03-2025 - Vivienne Westwood Shoes Melissa: A Bold and Sustainable Fash

When it comes to avant-garde fashion, few names are as iconic as Vivienne Westwood. Known for pushing the boundaries of design, Westwood’s creations blend punk-inspired aesthetics with timeless

Read more

05-02-2025 - The Sole Supplier: The Ultimate Sneaker Hub for UK Enthusias

In the world of sneakers, staying on top of the latest releases, restocks, and exclusive drops can be a challenge. For those who live and breathe sneakers, it's not just about finding a pair that

Read more

Author

Adam